In the last 7 days, global financial markets (crypto included) have been at the center of some dramatic and very bizarre events. As much as we’d like to avoid the Coronavirus topic, it impacted the financial world in a very significant way this week. Here’s a recap to put things in perspective.

Since last week we have seen:

- Global travel restrictions and national emergencies declared.

- The stock market fall to 2017 levels.

- Bitcoin crash to mid-2019 levels.

- New records set in market volatility.

- The Federal Reserve commit to $1.5 Trillion in new stimulus, remove reserve requirements for banks, lower interest rates to zero, and ponder the idea of universal basic income. Read More

The virus exposed many structural weaknesses in global financial markets, that much is true. Central banks around the world have either already created or are committed to creating trillions in new money to curb panic and market downside. It’s yet to be seen if their efforts will prove to be effective long term.

But let’s remember that this is exactly why Bitcoin was created. Bitcoin was born in the midst of the 2008 financial crisis, when bailouts were given to insolvent banks and hedge funds, when new money was created and given to the most irresponsible of market participants. There are many eerie similarities today.

Despite this chaos the past 7 days, Bitcoin carried on. It continued creating new blocks as scheduled every ten minutes. Its monetary policy remained unwavering. Its believers more convicted than ever.

Bitcoin Falls From $8,000

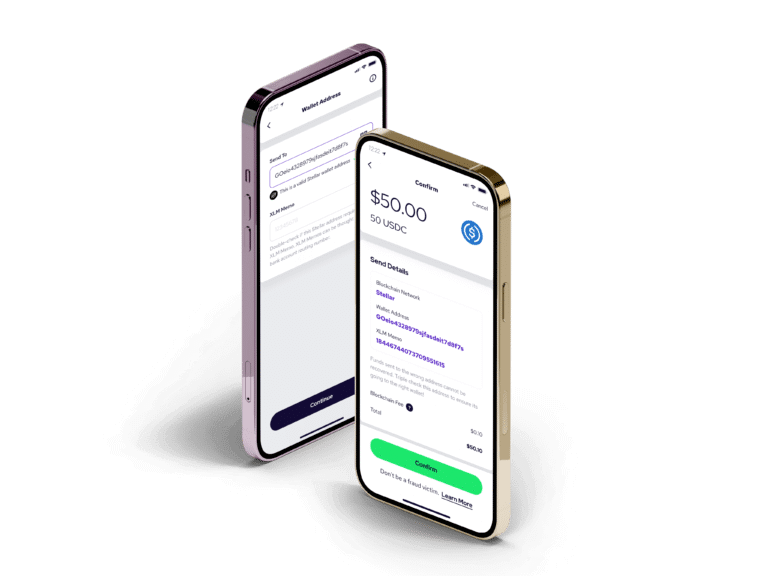

Use caution and stay safe if you visit a grocery store near you with a kiosk.