When talking about cryptocurrency, the words “coin” and “token” are sometimes used interchangeably.

However, they’re not quite the same. In fact, coins and tokens are two different primary types of cryptocurrencies. They both serve different purposes and bring unique advantages to crypto. In this article, you’ll find all the key coin vs. token differences and learn what purpose each type of cryptocurrency serves.

What is a coin?

Most of the time in the world of crypto, a coin is a virtual asset native to a blockchain. In other words, a coin is a foundational element of a blockchain. For example, bitcoin is the native coin for the Bitcoin blockchain, while ether is the native coin for the Ethereum blockchain. Coins provide essential services for the primary blockchain, such as acting like a unit of account.

To sum it up:

- Coins are the virtual assets native to a blockchain.

- Users can use coins to complete online transactions without going through traditional, regulated institutions.

- Coins must be created at the blockchain level as outlined by the governance rules. Proof-of-work and proof-of-stake are two popular mechanisms, but there are also other ways that coins can be created and distributed.

Examples of coins

There are thousands of crypto coins in circulation today. Some of these coins are currently worth less than a penny. Other coins are valued at hundreds or even thousands of dollars. While each coin offers its own pros and cons, several coins seek to advance bitcoin’s initial potential. Below are a few examples of crypto coins, each of which has its own blockchain network.

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

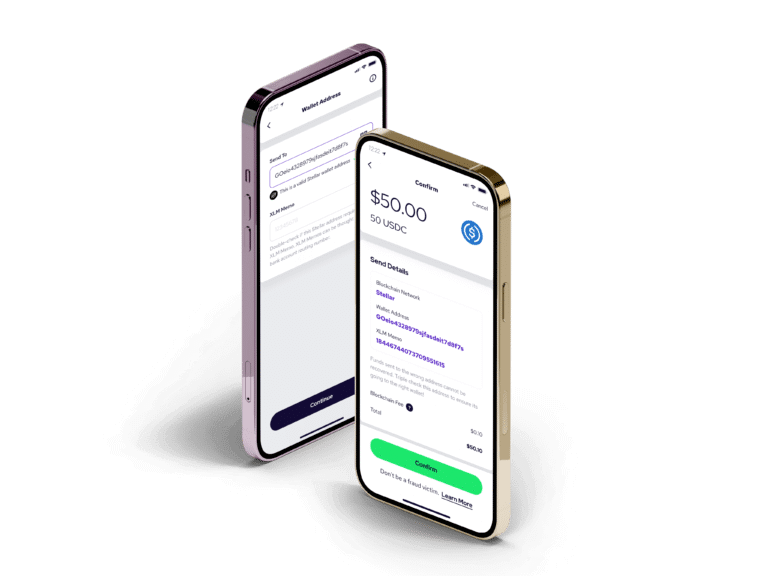

- Stellar Lumens (XLM)

- Cardano (ADA)

How can a coin be used?

Crypto coins and blockchains might seem like abstract ideas or immensely complex systems. And sure, you’d need some in-depth knowledge to participate in a digital coin’s underlying operations, but just about anyone can use these coins. Here’s how:

- Peer-to-peer transactions. One of the core functions of cryptocurrencies is to enable quick, low-cost transactions across the world. Many transactions take just minutes to process instead of the one or more days it can take to transfer fiat currency (traditional money).

- Purchases. One study has found that 32 percent of small businesses in the U.S. accept cryptocurrencies as payment for their products and services. While not all crypto coins are accepted, you can pay for products or services with popular coins such as bitcoin and ether.

- Hold for the future. Accurately predicting a coin’s future price can be nearly impossible. However, certain cryptos have increased in value over time.

What is a token?

A token is most often referred to a type of cryptocurrency that does not have an independent blockchain, but instead uses an existing protocol as its base-level infrastructure. They exist because the process of building new blockchains can require a lot of time, technology, and resources. As a result, many developers will create tokens on existing blockchains to capitalize on their current functions without having to create entirely new networks.

Tokens often expand the functions of existing crypto coins and improve their current capabilities. They use an existing blockchain’s smart contracts to signal the start of transactions between users. Tether, Uniswap, and Polygon are examples of crypto tokens (they are all based on Ethereum and use something called the ERC-20 token standard).

To sum it up:

- Tokens typically operate on a blockchain that initially belonged to another crypto asset.

- Tokens often improve the functionality of an existing coin or blockchain.

- Any company or organization can spin out a token based on a supported blockchain, which over time will lower the bar for creating new kinds of crypto-related products and services.

Examples of tokens

There are several types of cryptocurrency tokens, each of which serves specific purposes for blockchains, their apps, and users. The types of tokens include:

- Stablecoin tokens. A number of stablecoins exist as tokens. These tokens are minted on underlying blockchains, and are meant to have a 1:1 backing with a fiat currency like the dollar.

- Payment tokens. These tokens, also known as currency tokens, are the digital equivalent of fiat currency. Users exchange them for products or services at merchants that accept them. People also trade payment tokens for other cryptocurrencies or send them to other users’ digital wallets.

- Equity tokens. Also known as security tokens, equity tokens are like stocks in crypto form. When an investor purchases a company’s equity tokens, the company will often grant them special perks alongside shares of the company. The value of these tokens is directly tied to the company’s performance or success.

- Utility tokens. The most common type of crypto token, utility tokens help users perform actions within a blockchain. For example, Chainlink (LINK) is a utility token built on the Ethereum blockchain. LINK allows users to stabilize contracts on the network and increase data accuracy.

How can a token be used?

This type of cryptocurrency has specific functions, like supporting a certain blockchain or smart contract platform. For example, you can use LINK tokens to make purchases or perform operations on the Ethereum blockchain.

Crypto tokens also power decentralized apps (commonly known as “Dapps”) on a blockchain. The Ethereum blockchain, for example, uses specific tokens to manage and implement all its smart contracts. These tokens, called ERC-20 tokens, require developers to comply with certain requirements to create and operate dapps. Users can trade these tokens, but their larger purpose is to standardize Ethereum network use and scale usage off the main chain.

Tokens can also function like digital assets or deeds that act strictly as ownership licenses and don’t function as currency. A crypto token that represents a digital item is called a non-fungible token (NFT). These tokens are essentially digital deeds that use blockchain validators to state and confirm that you’re the sole owner of a product. Most NFTs are based on the Ethereum blockchain and, most recently, have signaled ownership of artworks.

What’s the difference between a coin and a token?

While both terms are somewhat interchangeable, we listed some subtle differences in this blog post for you to take away. Coins are mostly native to their own blockchains. While they serve a specific purpose within their networks, crypto coins can also be used as currency. Tokens, on the other hand, typically use existing blockchains to expand and improve the functions of those networks or develop processes of their own. Some tokens can be tradable currencies, while others serve as digital representations of ownership.