At Coinme, we believe that open and equitable access to bitcoin and other cryptocurrencies is the only way to create fair and viable financial systems. One massive opportunity to increase the adoption and utility of cryptocurrencies is through better education. We want to help educate the world how bitcoin and crypto fit into everyday financial life, what massive opportunities crypto presents, and especially how bitcoin and crypto can help people outside of the traditional financial system.

Come learn about Bitcoin, and educate yourself further about crypto as we aim to answer the most frequently asked questions about digital assets. Also, feel free to take our crypto literacy quiz to test your crypto knowledge.

What is coin market capitalization and does it matter?

Market Capitalization, or market cap, is a metric used to measure the total value of all the coins of a single cryptocurrency that have been mined. It’s calculated by multiplying the number of coins in circulation by the current market price of a single coin. Though the price of currency is more significant than its market cap value, there are still several reasons to consider a coin’s market cap.

Are there accessibility difficulties with crypto?

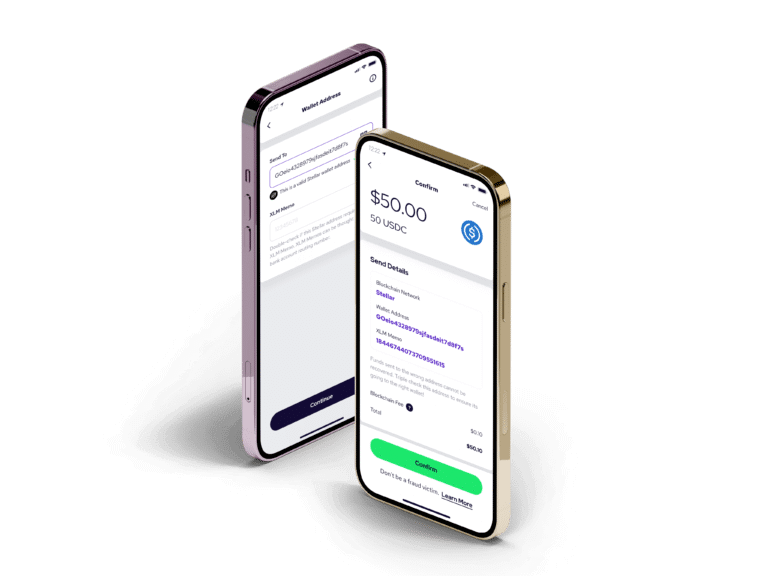

We don’t like to say “never,” but for the most part, there aren’t difficulties accessing your own crypto assets — this is one of the main reasons why cryptocurrencies were created. Bitcoin was created as a way for people to engage in financial transactions without exclusively relying on banks or governments — removing the barriers of entry into the financial ecosystem. Because crypto funds aren’t tied to a bank or to a government, they are much more likely to be readily available to you, no matter where you are in the world.

Additionally, because the system was designed to remove third-party intermediaries, transacting through digital assets can sometimes be less costly and quicker because the fees are generally a lot less and because you can make transactions at any time of the day or night.

What are NFTs?

An NFT, or a non-fungible token, is a digital asset that represents real-world objects like art, music, in-game items, and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.

In short, they are no different than a physical alternative asset, such as a painting, memorabilia, or a baseball card. The only difference between physical assets, like a painting, and an NFT, is that NFTs have a digital tracking system that can verify the authenticity of the asset.

Now, whether or not NFTs are worth it to buy, that depends on your financial situation and the marketplace. But just like physical pieces of art can attain a lot of value, so too can digital pieces of art.

How can I make money on money in addition to just seeing the price go up?

For many crypto traders who are in it for the medium or long haul, there are some other ways to make money on cryptocurrency that’s just sitting in your crypto wallet: staking and yield farming on DeFi networks.

At their most basic level, staking cryptocurrency and yield farming are pretty much the same thing: They involve investing money into a crypto coin (or more than one at a time) and collecting interest and fees from blockchain transactions. Whereas collecting interest from money left in your bank account can yield you 1-2% a year (at best), typical interest rewards from staking range from 5-14%.

What is a blockchain?

A Blockchain network is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system. A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain. In short, a blockchain is important and useful because transactions across the whole financial ecosystem can be verified and protected by a confirmation process.