A crypto winter is an extended period of lower prices than previous highs. Like bear markets in the stock market, many assets will see their value drastically decrease. While some cryptos do survive the winter, some never recover their value. Usually, crypto winters begin when there is a steep sell-off of bitcoin from a period high.

It’s official – crypto winter is here. You may have seen the term mentioned with a sense of foreboding. But what is a crypto winter?

Crypto winter is not a new phenomenon – there have been several before this one. The most recent crypto winter was from late 2017 to December 2020, when the prices of digital currencies fell from their previous highs. However, in 2020, the value of cryptos rebounded to record highs, kicking off a bull market.

How is a crypto winter predicted?

There’s no exact science to predicting a crypto winter. Still, one can observe certain behaviors and trends—staying updated with the latest news through outlets like CoinDesk and social media platforms like Twitter and Reddit may offer some insights. In addition, these sources provide the latest crypto prices and industry developments that can inform overall market behavior and direction.

What caused this crypto winter?

This crypto winter was set into motion in early 2022. There are several factors that market analysts point to, but some of the key ones include:

- Central banks tightening monetary policy: The U.S. government poured money into markets in response to the pandemic, causing crypto markets to soar in late 2020. However, the Federal Reserve raised interest rates in an effort to curb inflation. Crypto was affected by reduced liquidity, and prices of digital assets responded accordingly.

- Terra Luna Crash: TerraUSD (UST) was an algorithmic stablecoin that lost its 1:1 peg to the U.S. dollar. As UST’s price fell, investors withdrew their positions in the stablecoin.

- Three Arrows Capital Announced Liquidation: Crypto hedge fund Three Arrows Capital (3AC) announced it had fallen into liquidation, which in turn affected its industry partners that had made loans to the company.

How long will crypto winter last?

As mentioned above, there is no exact way to tell how long a crypto winter could be. The historical average is 303 days based on the winters starting June 2011, December 2013 and January 2018. Recently, Grayscale, a major digital asset manager, advised in its July insights report that crypto winter will last another 250 days. It bases this prediction on historical analysis and that crypto market cycles last about four years. We’re three years and a few months into the current cycle. According to Grayscale’s analysis, we may be experiencing crypto winter for a few more months.

To stay updated with the latest insights, be sure to subscribe to the Coinme newsletter and follow us on Twitter, @coinme.

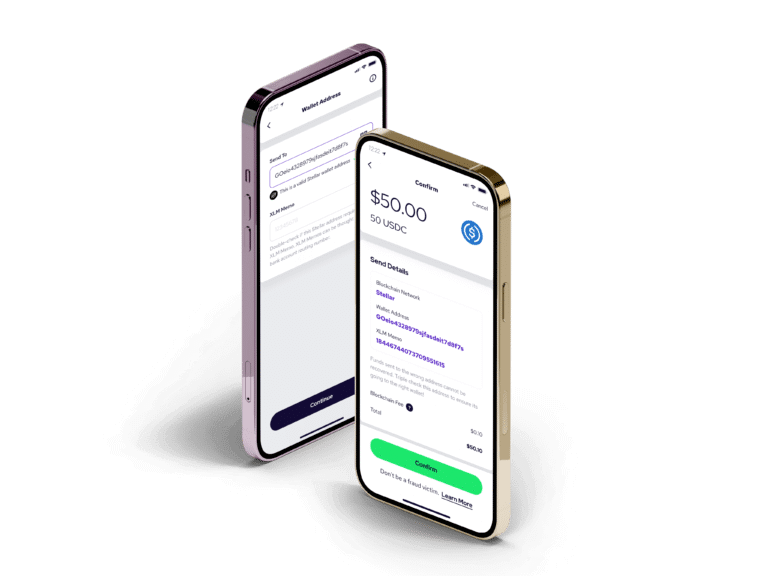

Current bitcoin price