Coinme was founded on May 1, 2014, and in honor of our 8-year anniversary, we are celebrating during the whole month of May and are continuing our series of interviews with Coinme employees. Last week, we spoke with Co-Founder and CEO, Neil Bergquist about starting Coinme. This week, we spoke with Sung Choi, the SVP of Strategy & Business Development, who shared with us stories about joining Coinme, Coinme’s partnerships, and the transformation of how crypto is perceived.

Coinme: What was your introduction to Coinme?

Sung Choi: I’ve actually known Neil (Berquist) for quite some years prior to Coinme being founded. And I look back at this, and think it’s a pretty funny story. Way before I was working for Coinme, I was actually at the opening night party where Coinme launched their first Bitcoin ATM at the Spitfire grill on May 1, 2014, and I remember thinking to myself at the time, ‘this is a terrible idea, why would someone want to buy digital currency with cash?” And then a few years passed, and then it just started to click for me. The more I dove into the cash use case for people that don’t have banking access, the more the idea made sense to me.

Coinme: When did Coinme’s service start to resonate with you?

SC: To be honest, I wasn’t too familiar with Bitcoin and Crypto at the time that Coinme was founded. Over the next few years, and with several conversations with Neil, I started to dive in and do more research and that’s when the use case to buy Bitcoin with cash really resonated with me. I’m an immigrant myself, and fortunately I had a better immigration journey than others, however, as I started to learn more about the difficulties that some immigrants face in regards to their money, Coinme just seemed like a really great idea. There are a lot of immigrants that face challenges in getting banking and having status, and there are others that have to jump through all these different hoops to turn their cash into something that is usable online. Thinking about these challenges re-framed how I was thinking about the product that Coinme was offering and how it could actually help people.

Coinme: What’s Coinme’s mission in terms of how they want to help people?

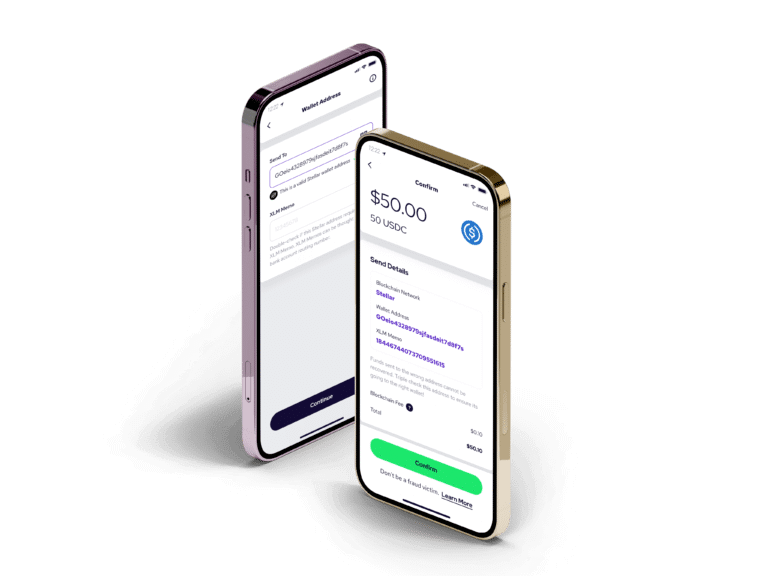

SC: I think initially, the vision was to make it really easy for people to turn cash into crypto and get more trust for crypto by offering a very simple way of interacting with digital currencies. And that original thought has really transformed into all the different ways to help the cash-using customer, or just people in general, and how we can give them a digital alternative. The crypto ATM is that easy alternative that people are familiar with.

Coinme: How did Coinme decide to look for partnerships?

SC: Before we ever thought about trying to make this a business strategy, we had conversations about how great it would be if someone could just walk up to a Coinstar machine and buy bitcoin there. There’s one of these machines everywhere and this would be an amazing partner, and we just thought that we should try to find someone at the company who we could talk to about the potential it had. These were conversations we had way before the thought of partnerships even crossed our mind.

Coinme: What has changed about Coinme since its inception?

SC: Once upon a time, we were operating our own machines, and we had them all over the country — and there’s actually a funny story about how we went about collecting these machines, I think there were 75 at the time — however, ultimately we decided, through a few different considerations, that we weren’t going to operate our own network of machines anymore. I think that was a big change, and frankly, we have partnerships with great companies who have a great network of machines. It just made more sense for our longevity to discontinue our own machines and use the great products that other companies were offering. And within a few months of that decision, our growth started to take off.

Coinme: Do you have any funny stories about your early years at Coinme?

SC: A fun story that I like to tell is that when I first started working with Coinme, our bank told us that they no longer wanted to work with a crypto company and so we called 200 banks all across the country before we got a “yes” — it was quite an effort just to find one bank that would work with us. And, obviously now it’s totally different because it’s a whole new world now for crypto companies and the crypto industry. And so, just from that perspective, we’ve really been able to see the financial industry understand crypto and understand the crypto industry, and they’ve come to realize that it’s not as scary as people think it is.

Coinme: Any exciting projects in the works for Coinme as we head into another year?

SC: One big thing that we are working on now, and ultimately this will help benefit all of our customers, is that we are working with financial institutions, such as banks, credit unions, fintech apps, or betting apps to offer a solution to give them the option of offering crypto to their customers. Really, we want to be able to help any company to have the ability to offer crypto to their customers, and this will impact not only institutions, but everyone. When there are more financial institutions that offer crypto as a service, everyone wins.